Despite the continued vulnerability of exchanges, centralized crypto markets continue to flourish. This year has borne witness to several notable hacks and exchange failures at Cryptopia, QuadrigaCX and most recently Bitrue. Hackers can target both the hot wallets of exchanges or users’ login credentials via phishing. The ProofofKeys event, aimed at pulling assets off exchanges, came and went, with little noticeable impact.

Adding to this risk is the increasing demands on centralized exchanges (CEXs) by governments. There is increasing pressure for more extensive KYC and AML provisions, and the delisting of assets that may be securities. Most recently we have seen the calls for increased data sharing between exchanges. The Financial Action Task Force, a global organization aimed at coordinating national financial policy, recently stated that nation-states ought to force exchanges to share customer data with each other, including names, account numbers, and addresses.

There are clearly serious downsides to using centralized exchanges then and yet they still thrive.

On the other hand, decentralized exchanges (DEXs) promise to solve both of these concerns. In the spirit of direct ownership, DEXs allow users to maintain control of their assets. These services have been hotly anticipated for several years and yet they are still to capture any significant market share. DEXs account for less than 1% of total exchange volume and have shown few signs of challenging the supremacy of their centralized counterparts.

In this article, we take a look at the reasons behind this inertia and what it will take to decentralize the exchange of crypto assets.

User Experience

Like any service, users migrate to exchanges that are intuitive, simple and easy to navigate. Although there are always going to be a much more technically savvy minority happy to navigate more obstructive designs, the vast majority navigate to sites that are easy to use.

Most DEXs still ask users to create their own wallets, manage and back up their keys. This introduces friction and makes the experience onerous and even daunting.

Indeed, people wrongly assume that most people want control over their crypto assets. One only has to look at the amounts currently stored on centralized exchanges and wallets.

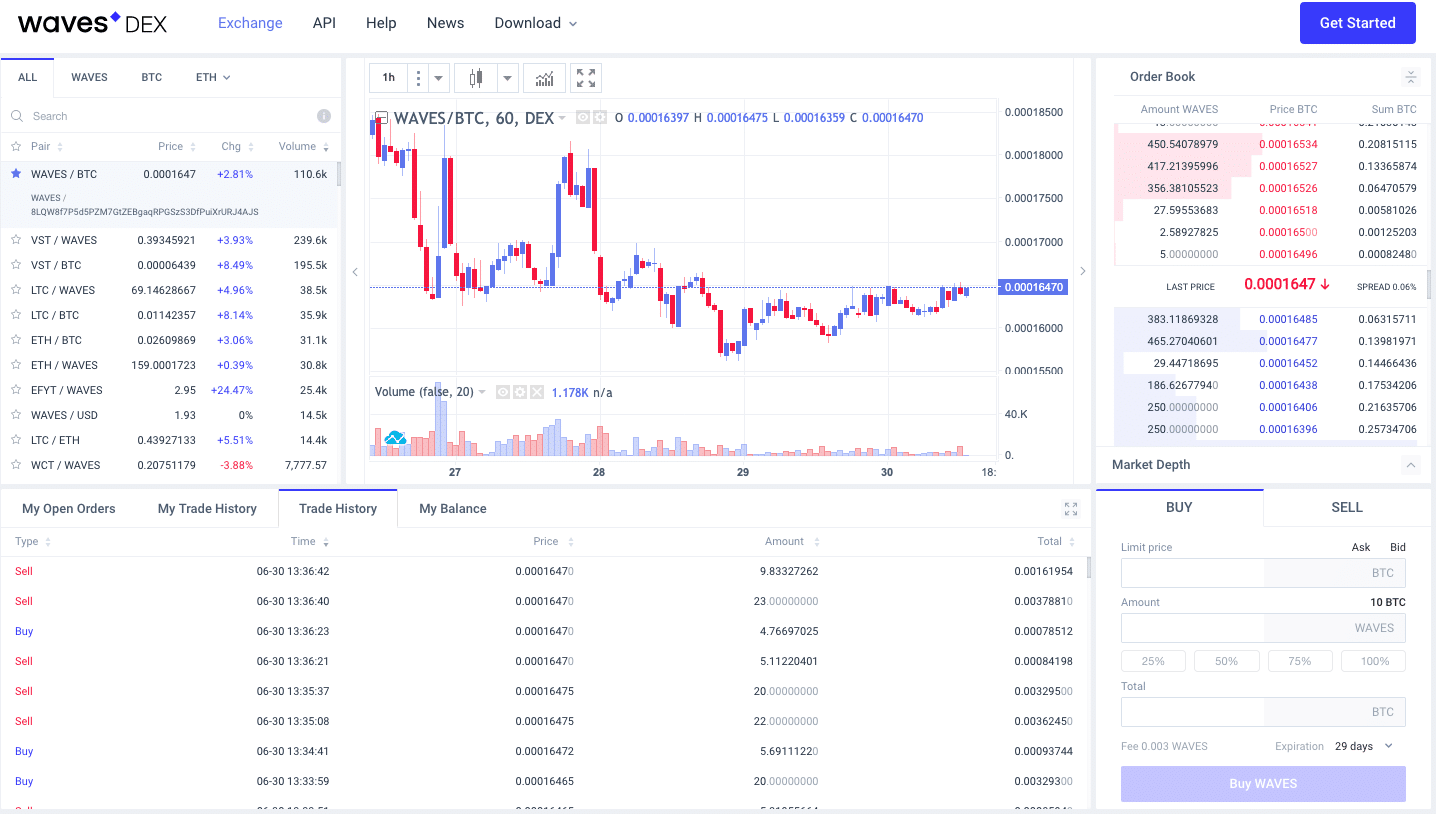

Aside from simplicity, user experience also depends on speed. DEXs are often far slower than their centralized equivalents. While regular exchanges use a central order book system to arrange and execute trades, DEXs often use smart contracts instead. As a result, users often find themselves waiting for on-chain confirmations before their trade is settled. This approach is not only slower but can also be more stressful, both of which deter the user, even if they can have greater control over their assets. Some DEXs such as Waves sacrifice this and instead opt for a centralized order matching system. This hybrid approach certainly offers a far smoother experience yet starts to chip away at the inherent advantages of a DEX through this centralization.

Furthermore, if a user makes a mistake on such an exchange or there is a service disruption, customer support is often missing. This is as much a symptom of immaturity more than anything else and is something easily remedied. Companies that can offer exchanges with a decentralized infrastructure while maintaining excellent customer support should excel.

Liquidity

Traders moving in and out of positions are wholly dependent on sufficient liquidity. Liquidity refers to the ability to buy or sell an asset at market price without experiencing slippage. Without sufficient liquidity, there can be no real volume as medium and larger traders avoid an exchange entirely.

Low liquidity is commonplace on almost all DEXs. This is a result of insufficient incentives to move from high-performance CEXs as well as undeveloped market making functionality.

DEXs can be extremely useful for trading more obscure assets or ones delisted by CEXs out of regulatory fears. However, for now, nearly all the liquidity for major assets remains at the major CEXs. Until there is a sufficient incentive for market makers and bigger players to migrate, there will be little chance of this changing.

Sophistication

Larger traders and institutional clients are often attracted to an exchange’s services beyond simple spot trading.

Such users often expect more complex services such as margin trading, the ability to short assets, futures contracts and derivatives contracts such as options. These offerings, for now, depend on centralized infrastructure and excellent liquidity.

Theoretically, such offerings should be possible on DEXs through smart contracts and other mechanisms. Indeed, this evolution would likely close the gap between the two while also bringing increased liquidity due to the large position size of traders seeking these services. This would in turn fuel more demand for spot trading and increase usage further.

Privacy

This next issue is one often overlooked. While many people promote the usage of DEXs as a way to circumvent onerous KYC requirements by CEXs, there are actually serious privacy reasons for avoiding a DEX altogether.

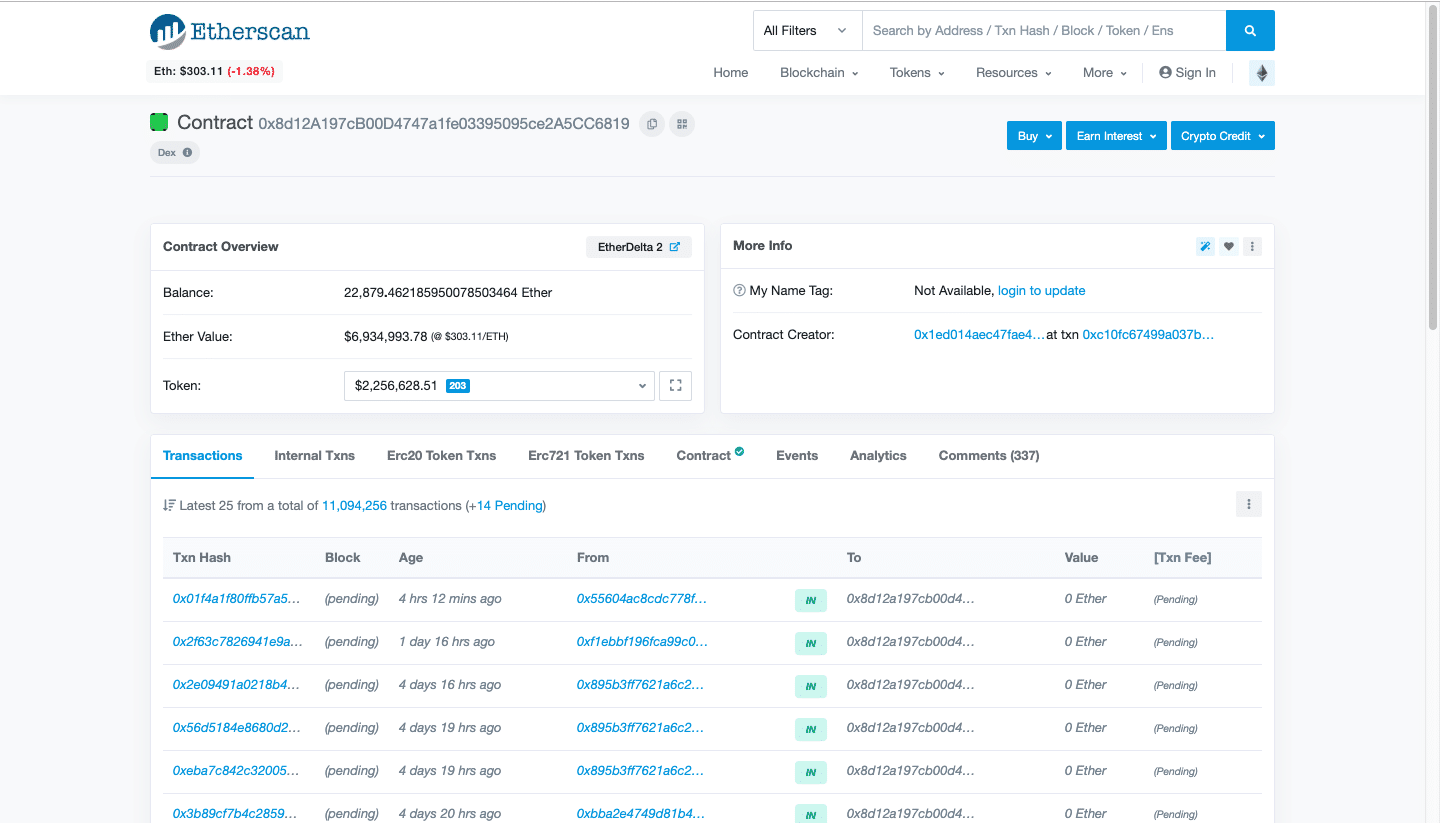

If a DEX is executing trades on a blockchain such as Ethereum, then traders are leaving a permanent and publically visible record of every trade they execute. Exchanges like ForkDelta, for instance, fall into this category as does any service using layer one solutions for trade execution.

Theoretically, this problem could be avoided by using blockchains with enhanced privacy. However, for now, this is not feasible due to the significant increases in transaction size that this incurs. More sophisticated DEXs however now typically use second layer networks and sidechains, whereby user privacy can be secured.

[thrive_leads id=’5219′]

Incentivization

Ultimately, for most users, there is quite simply insufficient pressure or incentive to switch to a DEX.

While the industry continues to experience exchange hacks, the major exchanges have robust security and respond professionally in such events as the recent Binance hack has shown.

The superior user experience, liquidity and range of services for now simply outweigh the perceived risks of counterparty custody and government oversight. DEXs still represent a fringe service, however, with continued technological advances and a more professional attitude, such exchanges could start to rival their centralized rivals within the next few years.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.